For many years now, the story in people’s minds has been that college costs have been on a long, unbroken upward trajectory, rising a lot faster than inflation.

We’ve become accustomed to the stories. “Ivy League College Costs Soar to More Than $90,000 a Year,” says Bloomberg. “Yearly college costs near $100k at Vanderbilt, other schools,” reports the College Fix. Some stories, like the Brookings Institution’s recent report, note that costs after financial aid have decreased for students who receive assistance. But the thrust of all these stories has been the same for years. College costs are soaring.

However, in contrast to the prevailing narrative, college costs have been on a downward trend for several years. That’s a cause for optimism. Let’s delve into the data. Each year, the College Board, Petersons, and U.S. News and World Report compile data from American colleges and universities. They include data from community colleges, large state flagship universities, liberal arts colleges, Ivy League institutions, and religious colleges. This comprehensive data – the Common Data Set – covers academic programs, admissions, enrollment, and cost data.

Prepare to have your expectations challenged. The College Board’s annual report, ‘Trends in College Pricing,’ presents data that may surprise you. Here are some intriguing highlights.

Good news! Published (‘Sticker’) Prices Are Going Down

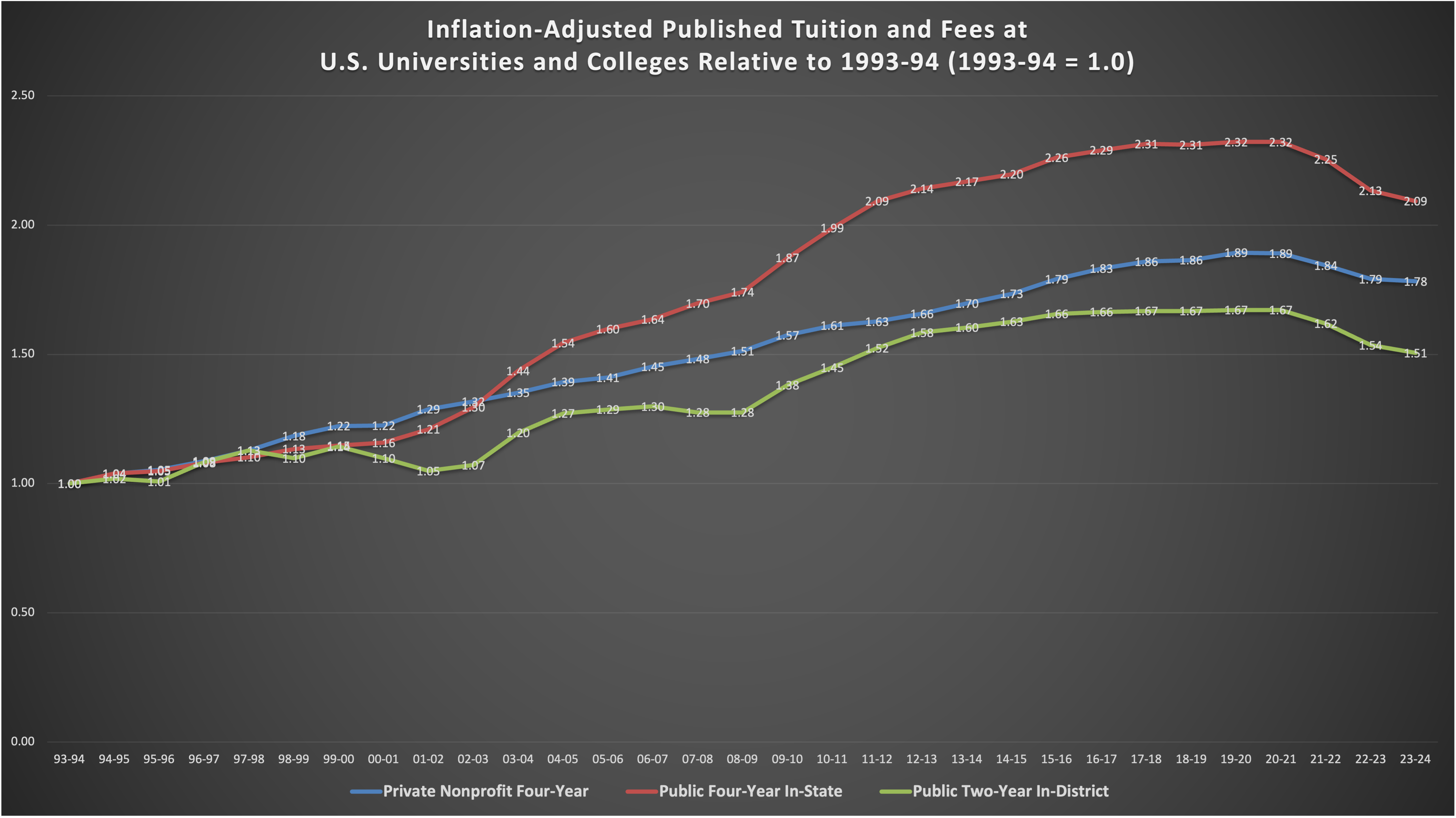

The figure below summarizes the sticker costs of private four-year universities (like Stanford University or Gettysburg College), public four-year universities (like the University of Michigan or Texas Tech), and public two-year colleges (community colleges). It’s adjusted for inflation, which means it compares the cost of college to the costs of other things. Adjusting for inflation is the most meaningful way to compare costs over time since prices and incomes change a little or a lot each year for most things and most people.

The figure shows a definite turn in 2020-21, the pandemic year, when prices started decreasing. But even before that, the rate of growth had slowed. Why the U-turn?

The 2008 financial crash significantly impacted state budgets for public universities, leading to price hikes. However, as the economy recovered, the rate of cost increases slowed. Then, the pandemic and immigration restrictions during the Trump era severely affected college enrollment, forcing universities to cut costs and prices. And now, with a shrinking pool of high school graduates each year, colleges in the United States are in a competitive market, driving prices down.

The Price of College Is Going Down Almost Everywhere

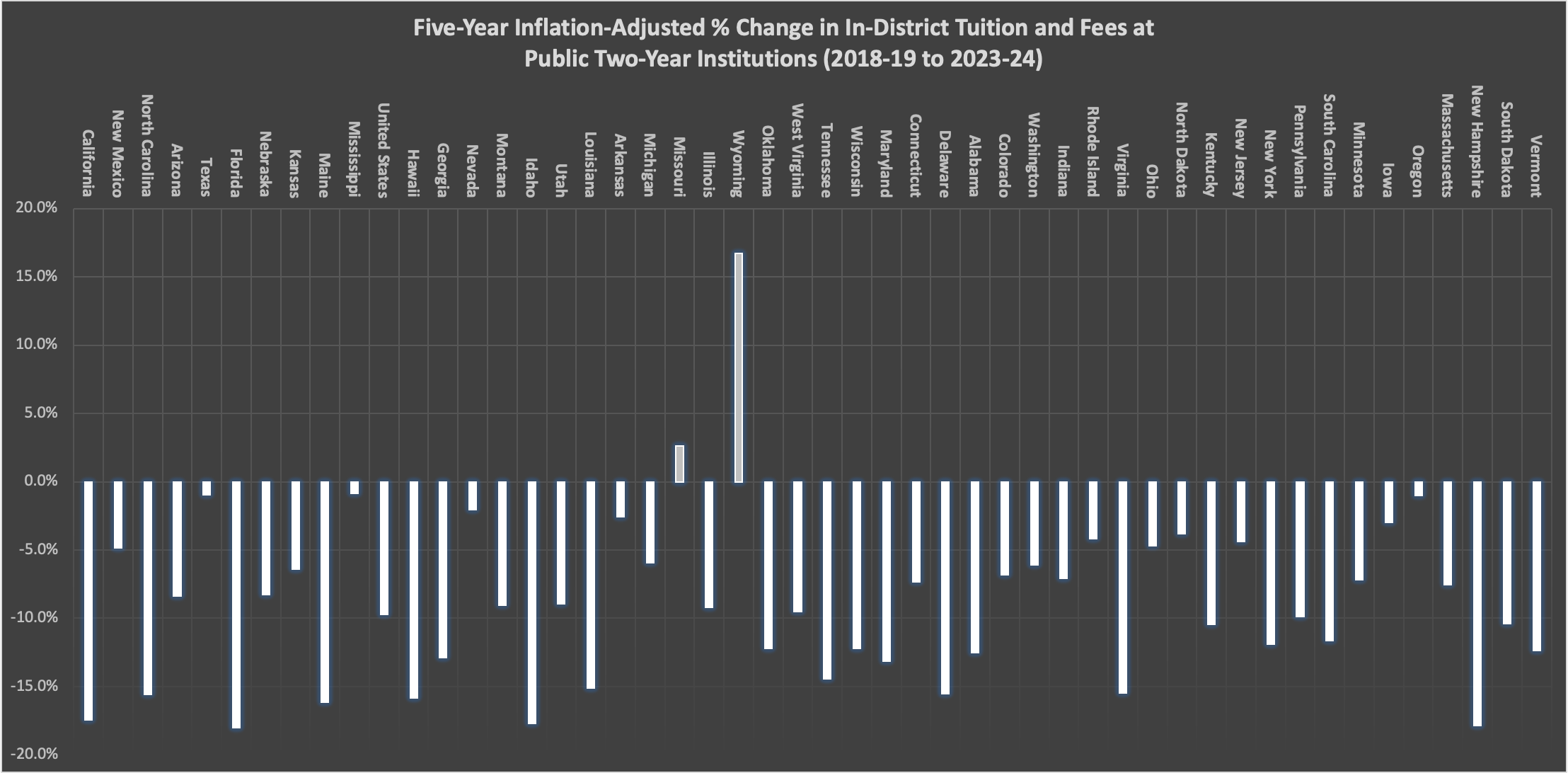

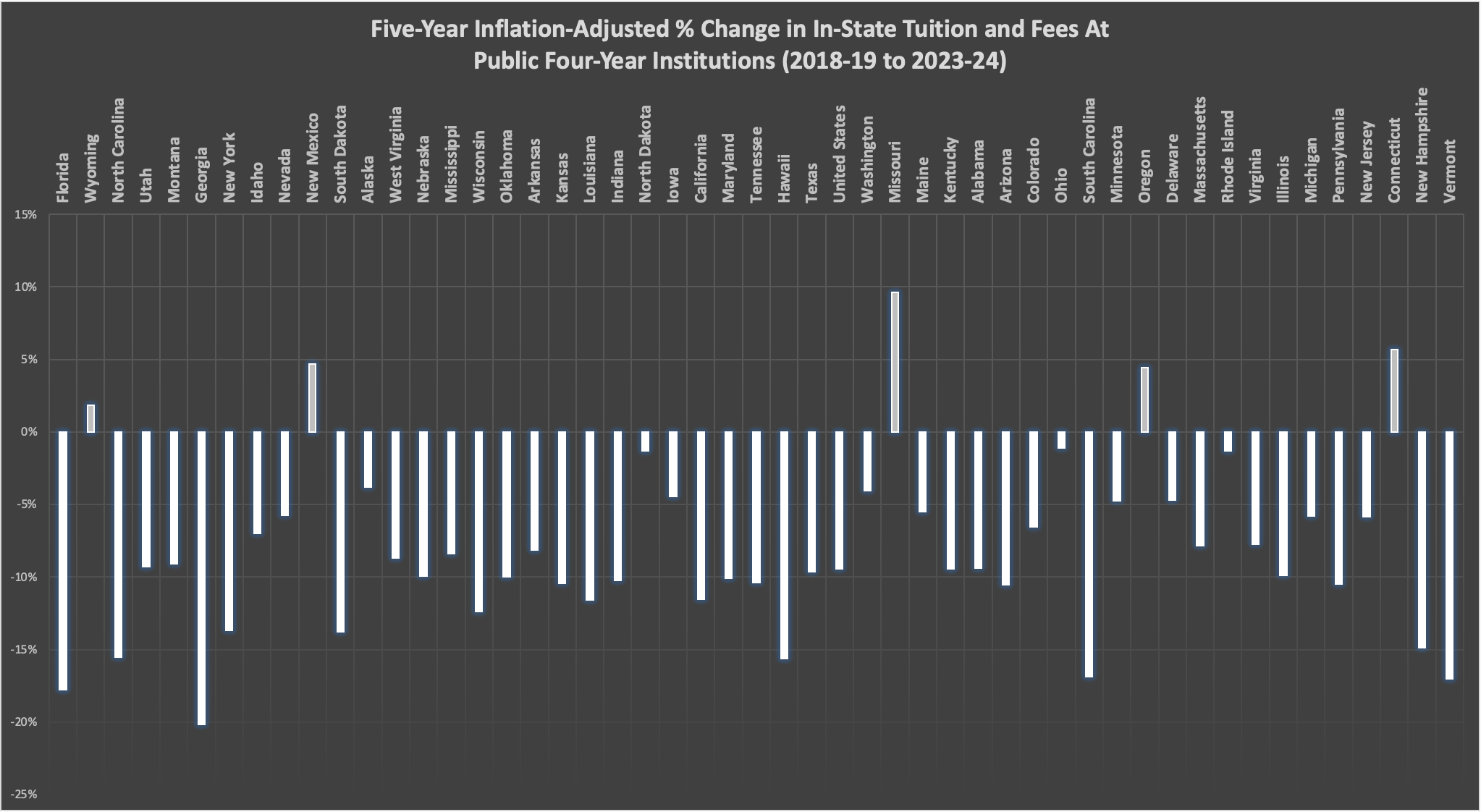

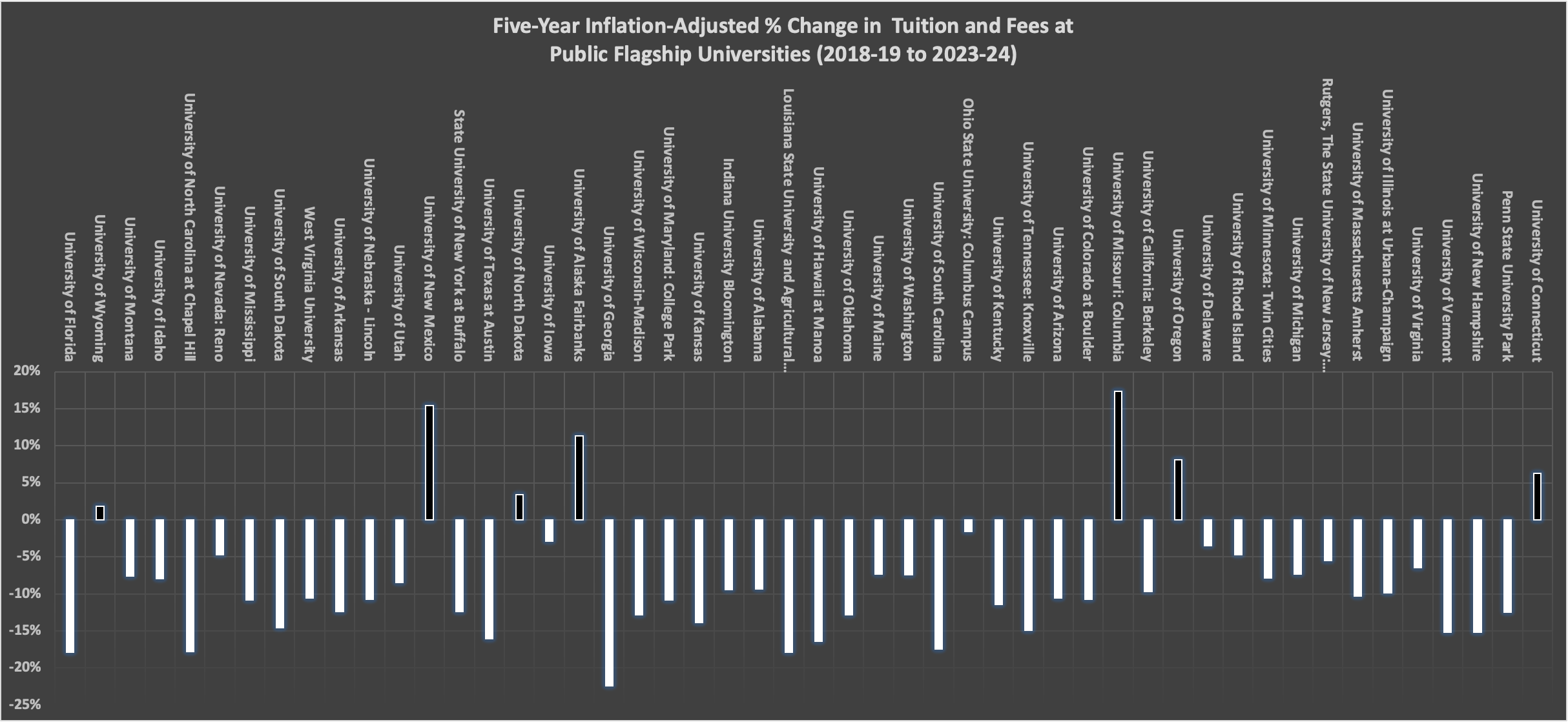

You may be tempted to retort that prices are going down only at smaller colleges, which face struggles with enrolling their classes, or states struggling to attract out-of-state students or keep in-state students from leaving. But that’s not true either.

The figures below show the five-year change in tuition and fees at public four-year and public two-year colleges in every state. You’ll see that nearly everywhere, costs have gone down. Tuition has declined even at flagship state universities, such as the University of California, Berkeley, or the University of Michigan, Ann Arbor.

Some of the relative decline is because prices went up generally in 2022 and 2023, which means the effect of inflation made changes in college prices seem less extreme. However, the changes are too significant to be explained by rising inflation.

Net Prices Families Pay Are Going Down, Too

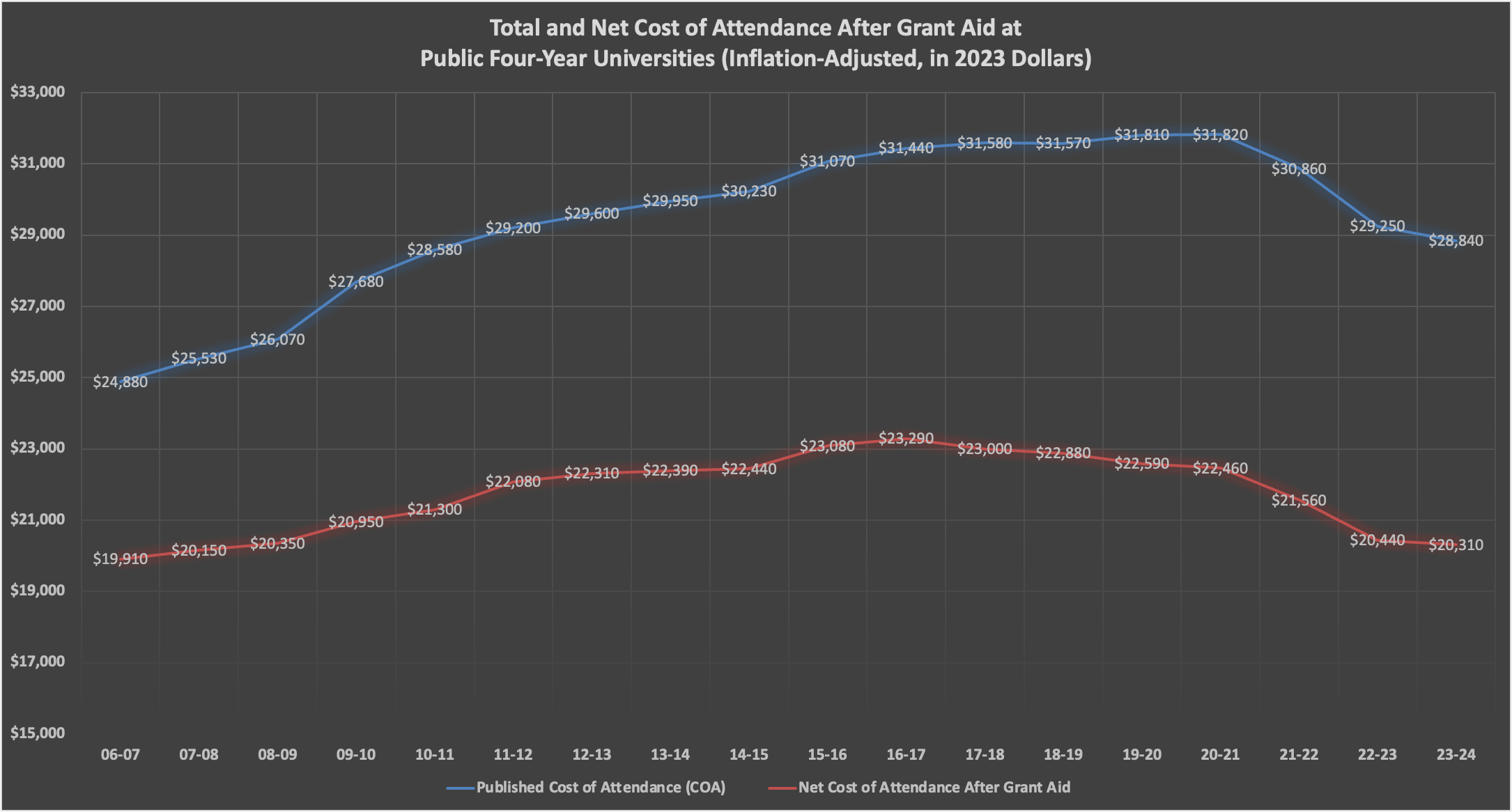

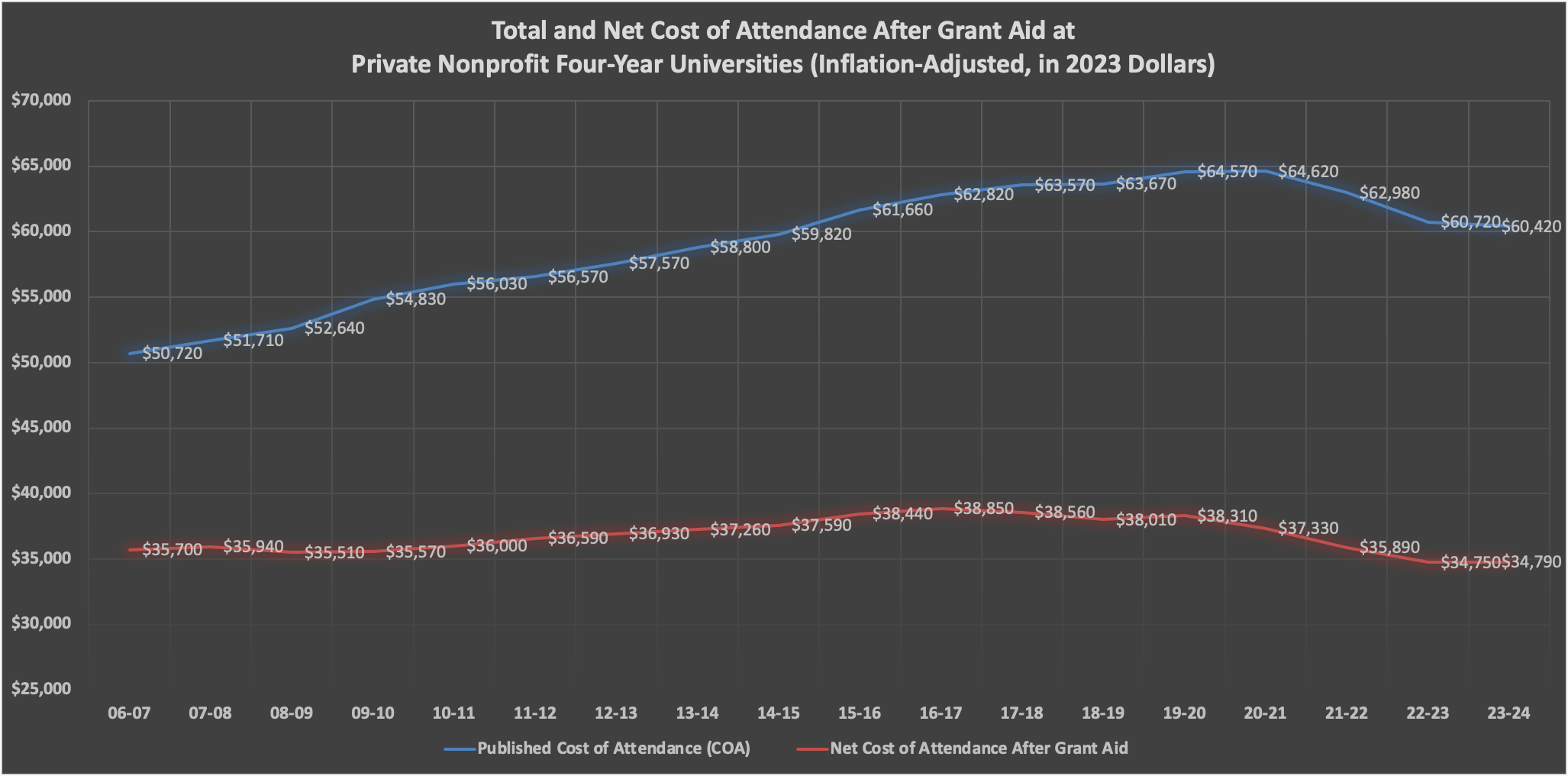

Not only are the listed prices (“total cost of attendance”) at colleges nationwide going down, but so are the prices families actually pay on average after grant aid—like Pell grants, state grants, and institutional scholarships and grants. At private and public universities, on average, families pay less for college than they used to (adjusted for inflation).

The figures below show the total costs of private and public four-year universities and their net costs after grants. In each case, the curves turn around 2020-21 and are headed down.

What’s Driving the Changes?

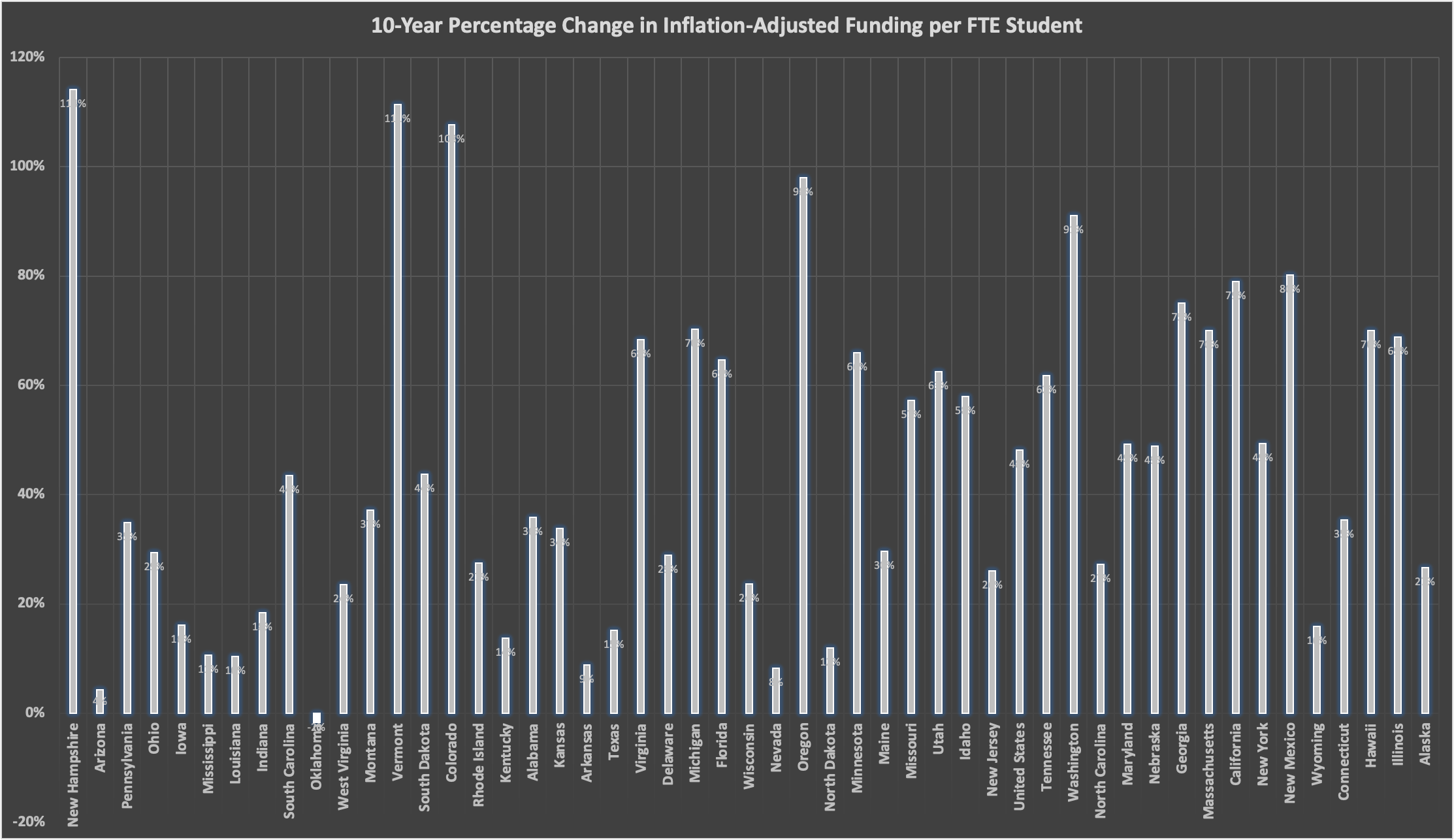

How are colleges managing to cut their prices? For many years, state subsidies offered to public universities were declining, especially after the 2008 financial crash decimated state budgets. But since then, state finances have rebounded, and state subsidies to public universities have gone up, as the figure below shows.

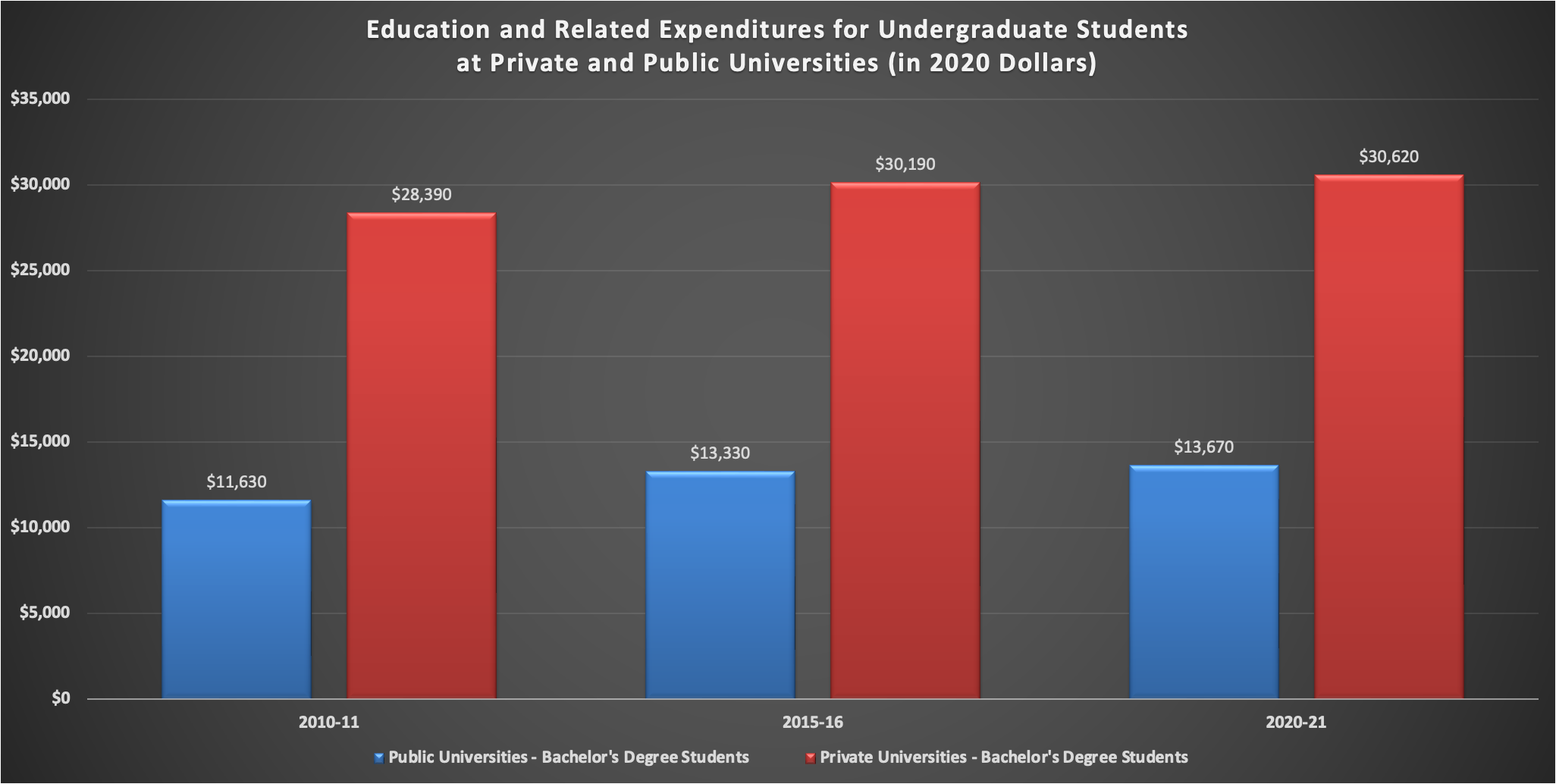

Also, driven by many societal changes, colleges have tightened their budgets. The stories about soaring administrative budgets and lavish student facilities – like Louisiana State University’s “lazy river” – have pushed colleges to become more cost-conscious. The figure below shows how education-related costs at both private and public universities have leveled off in recent years.

Sadly, Not Everyone Benefits

All of this is good news, but not everyone will benefit. Some very selective universities—like those in the Ivy League—have continued to raise prices. The reasons are somewhat unclear, but Occam’s Razor explains that they’re raising prices because they can. During the pandemic and afterward, applications to these colleges skyrocketed, and they became much more selective. Raising prices allows them to take advantage of soaring demand.

Second, grant aid – like the Pell Grant and state aid grants – has not kept up with inflation, so low-income students who rely on those grants still have costs that are too high relative to their ability to pay.

Finally, many middle and upper-income students still need help with the big holes in the financial aid system that make them ineligible for need-based financial aid.

But after many years – decades – of rising college costs, it’s important to celebrate the achievement. The cost of college is finally declining, allowing us to finance improvements in the system that make college more affordable to everyone!

0 Comments